Decoding quickcommerce Advertising Trends: A Deep Dive into TV, Print, Radio, and Digital (2022-2024)

1. Introduction: How Advertising is Shaping the Future of E-commerce

E-commerce has revolutionized the consumer shopping habits, making instant deliveries of groceries, essentials, and even luxury items. It has become the new normal. With platforms like Blinkit, Zepto, and Swiggy Instamart, customers now expect their orders within minutes, not hours. But as the industry continues to evolve at breakneck speed, how has advertising kept up with this change?

In a world where attention spans are shrinking and competition is tough, advertising helps brands in gaining visibility, customer acquisition, and market dominance. Whether it’s a catchy TV commercial, a high-impact print ad, a radio jingle, or a hyper-targeted social media campaign, E-commerce brands must navigate a constantly changing advertising landscape to stay ahead.

In this blog we have analyzed advertising trends from 2022 to 2024, examining shifts across TV, Print, Radio, and Digital platforms. From the decline of traditional media to the rapid rise of digital advertising, we have discussed strategies used by top advertisers like Amazon Online India, Flipkart, and Reliance Retail to capture consumer attention.

Why Advertising Trends Matter in E-commerce

E-commerce is not just about fast deliveries, it’s about creating a seamless shopping experience that aligns with the consumers' needs. Advertising is the bridge that connects brands with their audience, and understanding trends is important for staying relevant. Here’s what we’ll cover:

- The Shift to Digital: Digital dominates with 63% of ad spends in 2024, while platforms like Facebook and X (formerly Twitter) offer great reach and engagement.

- The Decline of Traditional Media: TV, Print, and Radio ad spends have dropped by 66%, 52%, and 66% respectively from 2022 to 2024 but still holds important value for regional and niche based campaigns.

- Top Advertisers: Amazon Online India leads across all media, followed by Karma shopping and Flipkart, offering valuable lessons for smaller brands.

- Seasonal Peaks: Advertising in E-commerce is highly seasonal, with spikes during festive periods (Aug-Nov) and weekends, allowing marketers to optimize campaigns for maximum impact.

2. The Big Picture: Key Trends in E-commerce Advertising

Declining Ad Spends: A Shift in Marketing Strategies

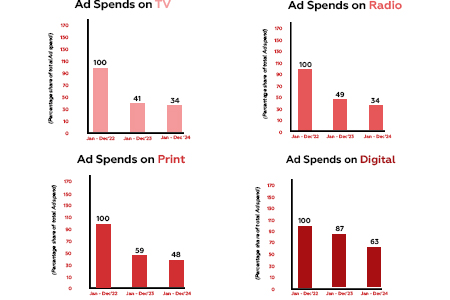

From 2022 to 2024, ad spends across all media channels have declined:

- TV: -66%

- Print: -52%

- Radio: -66%

- Digital: -37%

Why is it declining?

- Economic Constraints: Rising inflation and budget cuts force brands to rethink ad spendings.

- Reallocation to Performance Marketing: Companies now prioritize direct ROI-driven campaigns like Meta and Google ads.

Market Maturity: With E-commerce stabilizing, initial aggressive ad investments have slowed.

Digital Takes the Lead: Dominating the Ad Space

With 63% of total ad spends in 2024, digital media now leads E-commerce advertising. Popular platforms include Facebook, X (formerly Twitter), and YouTube.

Why Digital is Winning:

- Advanced Targeting: Brands can segregate audiences based on behavior and interests.

- Better ROI: Digital campaigns offer cost-effective solutions with measurable impact.

- Real-Time Optimization: Data-driven decisions allow for quick adjustments to maximize performance.

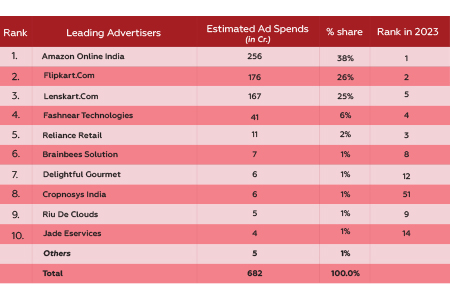

The Industry Leaders: Top Advertisers in E-commerce

Amazon Online India dominates across all media, conquering its position as the undisputed leader. Karma Shopping leverages print and radio for localized targeting, while Flipkart focuses on celebrity-driven campaigns featuring Alia Bhatt and Sara Ali Khan for high-impact engagement. Key lessons from market leaders highlight the importance of consistency in building brand recognition, the power of diversified advertising across digital, TV, and print for maximum reach, and the effectiveness of celebrity endorsements in boosting visibility.

Seasonal Advertising Trends

Peak Ad Spending Periods

- Festive Season (Aug-Nov): Spikes in ad investments around Diwali, Christmas, and New Year.

- Weekend Focus: Higher engagement levels drive increased ad spending.

Strategic Takeaways for Marketers:

- Plan Campaigns Around Key Shopping Seasons: Ensure brand visibility during high-demand periods.

- Leverage Urgency Marketing: Use limited-time offers to drive conversions during peak shopping periods.

1. Overall Decline in Ad Spends: A Sign of Changing Times

Between 2022 and 2024, ad spends have seen a significant decline across all media channels, with TV and radio experiencing a 66% drop, print decreasing by 52%, and digital falling by 37%. This decline is because of several factors, including economic pressures such as inflation and tighter budgets, forcing brands to reduce their advertising expenses. Additionally, companies are shifting their priorities toward performance marketing and customer retention strategies rather than broad-based advertising. Market saturation has also played a role, as the initial rush to capture market share in the E-commerce sector has slowed, reducing the need for excessive ad spends.

For marketers, this changing landscape emphasizes the need to focus on return on investment (ROI) and prioritize high-performing campaigns. With shrinking budgets, it’s important to optimize ad spending by allocating resources to channels that offer the highest engagement and conversion rates. Strategic investments in targeted and data-driven marketing efforts will be key to sustaining brand growth in an increasingly competitive and cost-conscious environment.

Television Advertising: The Decline of a Giant in E-commerce

Between 2022 and 2024, television advertising in the E-commerce sector declined by 66%, reflecting shifts in consumer behavior and the growing dominance of digital marketing. As audiences increasingly engage with online platforms, brands have reallocated budgets to targeted and measurable digital channels, moving away from traditional TV ads due to their high costs and limited tracking capabilities. Despite this decline, some brands continue investing in television for strategic purposes, primarily for brand recall and high-impact campaigns. Amazon Online India leads in E-commerce TV ad spending with a 38% share in 2024, while Flipkart and Lenskart also maintain a presence, particularly during major sales and festive periods.

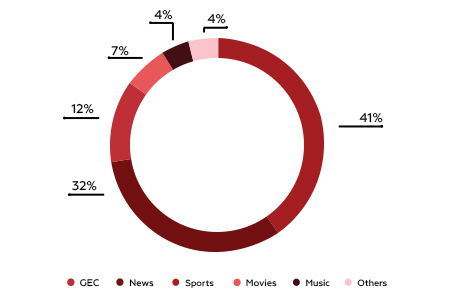

Television advertising strategies have evolved, with brands becoming more selective in their placements. General Entertainment Channels (GECs) attract the highest share of ad spending at 41%, followed by sports channels at 32%, mainly driven by cricket tournaments. Movie channels receive 12%, and 52% of E-commerce TV ads are aired during prime time (6 PM – 11 PM) for maximum viewership. Celebrity endorsements remain a crucial component, with 46% of TV ad volumes featuring celebrities. Sara Ali Khan led with a 16% share for Shopsy App, while Alia Bhatt contributed 13% to Flipkart’s campaigns, alongside endorsements from Ananya Panday, Boman Irani, and Aditya Roy Kapur. Despite the digital shift, celebrity-driven campaigns continue to enhance brand credibility and engagement.

Print Advertising: Holding Ground in a Digital World

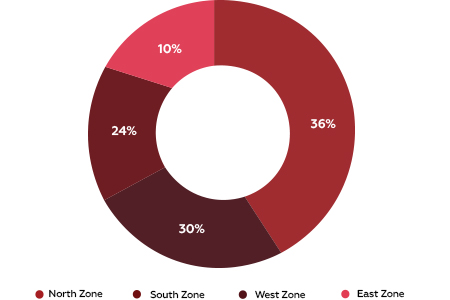

Despite a 52% decline in print ad spending between 2022 and 2024, the medium remains a strategic asset for E-commerce brands, particularly for visibility, regional outreach, and trust-building. The shift toward digital marketing, declining newspaper readership, and the cost-effectiveness of online platforms have contributed to this drop. However, leading brands like Amazon, Reliance Retail, and Flipkart continue investing in print for high-impact campaigns, seasonal promotions, and brand reinforcement. North and West Zones dominate print ad spending, with newspapers serving as a credible channel for engaging non-digital consumers. Regional newspapers, in particular, allow brands to tailor their messaging to specific markets, ensuring a more localized and targeted reach.

Front-page placements remain the most sought-after print advertising strategy, commanding 62% of ad placements due to their high visibility and credibility. Promotional content, such as discount-driven ads, continues to dominate E-commerce print advertising, making up nearly half of total spending. Despite the digital revolution, print advertising still offers unmissable brand exposure, especially for regional engagement and credibility. While its role has evolved, E-commerce brands are leveraging a balanced marketing approach, integrating print alongside digital for maximum consumer impact.

Radio Advertising: A Niche but Relevant Medium

Radio advertising has also witnessed a decline similar to that of television. Between 2022 and 2024, E-commerce brands reduced their radio ad spending by 66%, largely due to the growing preference for digital platforms and changes in commuting patterns. The transition to remote work has diminished peak-hour radio listenership, reducing its effectiveness as an advertising channel. Additionally, radio’s limited ability to provide measurable results has made it less attractive for brands seeking data-driven marketing approaches. However, some companies, such as Reliance Retail and Amazon Online India, continue to use radio for regional targeting and brand awareness.

While traditional advertising channels like television and radio have seen a sharp decline in ad spending, they still hold value when used strategically. E-commerce brands are increasingly adopting a multi-channel approach, blending digital marketing with selective television and radio placements to maintain brand presence across different consumer touchpoints. Moving forward, the industry is likely to see further integration of data-driven strategies to optimize advertising investments, ensuring that every channel is utilized for maximum impact.

Key Takeaways and Future Outlook

What’s Next for E-commerce Advertising?

AI & Automation: Get ready for a big leap in AI-driven advertising! Tools like Google Performance Max and Meta Advantage+ are making campaigns smarter and more efficient. Marketing expert Neil Patel predicts that AI-powered personalization will shape the future, helping brands create hyper-targeted campaigns with ease.

Hybrid Strategies: The smartest brands won’t rely on just one approach; they'll mix digital with traditional media for maximum impact. A report from eMarketer shows that brands using both see a 27% boost in brand recall and customer engagement.

Smarter Analytics: Tracking performance across different platforms is more important than ever. Google’s latest insights highlight the need for multi-touch attribution, helping brands understand the entire customer journey and make better marketing decisions.

Final Thoughts

The future belongs to brands that embrace digital transformation while strategically leveraging traditional media for credibility and mass outreach. Industry leaders from marketing agencies like HubSpot advocate for a mix of performance-driven digital campaigns and high-impact traditional placements to ensure maximum reach.

E-commerce advertising is evolving rapidly, and those who adapt to emerging trends will stay ahead of the competition.

FAQs

Maximize your ad spends and drive business results with expert guidance from a leading advertising agency. Whether launching a digital campaign, optimizing traditional media, or creating a multi-channel strategy, get expert insights at Excellent Publicity today.