Personal Healthcare Sector Advertising in 2024: Trends, Insights & Regional Dominance

Table of Content

- 1. About Excellent Publicity

- 2. Ad Spend Trends in the Personal Healthcare Sector (2023–2024)

- 3. Preferred Media for Healthcare Advertising

- 4. Number of Advertisers: A Shift Towards Digital

- 5. Leading Advertisers on Television

- 6. Exclusive TV Advertisers in 2024

- 7. Preferred Channel Genres

- 8. Preferred Time Bands for TV Advertising

- 9. Print Advertising Trends

- 10. Radio Advertising Trends

- 11. Digital Advertising Trends

- 12. Seasonal & Temporal Trends

- 13. Celebrity Endorsements

- 14. Key Takeaways

- 15. Conclusion

The personal healthcare sector has emerged as one of the most dynamic and rapidly evolving industries in advertising. With rising consumer awareness, digital adoption, and changing lifestyle needs, healthcare brands are reshaping their marketing strategies to capture audience attention across multiple channels.

A recent report by Excellent Publicity, derived from over 7,000 campaigns and supported by data from TAM Media Research, provides a detailed view of how the personal healthcare advertising landscape has transformed in 2024. From ad spend shifts across media channels to celebrity endorsements, exclusive advertisers, and regional dominance, the insights are both profound and forward-looking.

This blog dives deep into the findings of the report, analyzing each trend to help businesses, marketers, and stakeholders understand where the sector is heading and how they can adapt.

About Excellent Publicity

Headquartered in Ahmedabad, Gujarat, Excellent Publicity has been a trusted partner in advertising for over 13 years. With expertise spanning media planning, digital marketing, influencer collaborations, sports marketing, corporate gifting, and creative solutions, the agency has executed more than 1.5 lakh campaigns and built strong ties with over 50,000 vendors.

Operating across Metro and Tier II cities in India and the MENA region, Excellent Publicity has helped 3,000+ happy clients scale their marketing goals. With seven offices in India and the UAE, the agency is expanding globally, staying ahead of trends to deliver impactful campaigns.

Ad Spend Trends in the Personal Healthcare Sector (2023–2024)

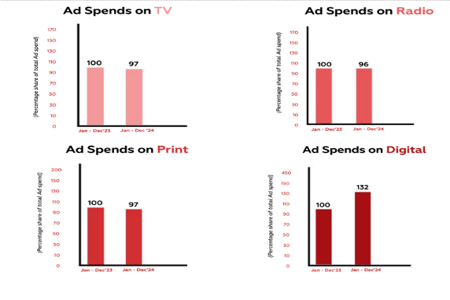

Decline in Traditional Media

The analysis reveals that television, print, and radio all experienced declines in ad spends in 2024 compared to 2023:

Television: Ad spends fell by 3%, indicating reduced reliance on TV as a primary medium.

Print: Similar to television, print advertising also saw a 3% decline.

Radio: Dropped by 4%, reflecting advertisers’ gradual shift from audio-only formats.

Digital Advertising:On the contrary, digital advertising skyrocketed by 32%, making it the most promising growth medium in 2024. With the healthcare audience increasingly consuming content online, this surge reflects a long-term structural change.

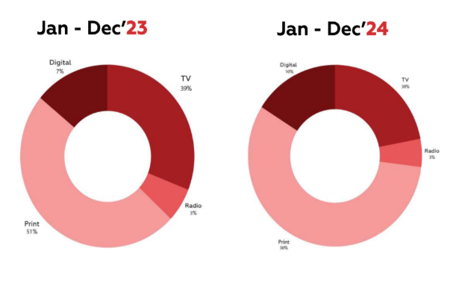

Preferred Media for Healthcare Advertising

Despite the decline, print remained the most preferred advertising medium for the personal healthcare sector in 2023, peaking at a 51% share. However, digital media gained momentum in 2024, eating into the traditional share.

Television dropped by 3% in ad spend share.

Digital saw the largest boost with a 32% increase in spending and advertisers.

This shift is a strong indicator of digital’s growing dominance.

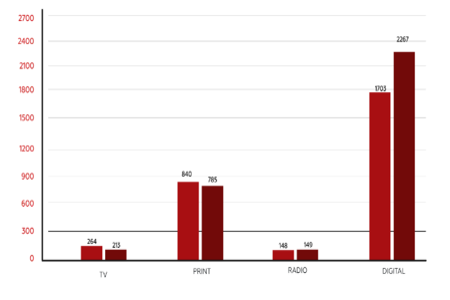

Number of Advertisers: A Shift Towards Digital

The report shows significant changes in advertiser preferences:

Digital: Attracted the highest number of advertisers, with a 33% increase in 2024.

Radio: Saw a marginal 1% increase.

Television: Declined by 19%, a steep drop in advertiser count.

Print: Fell by 7% in advertiser participation.

Clearly, brands are migrating to digital platforms for greater reach, flexibility, and measurable ROI.

Leading Advertisers on Television

2024

Reckitt Benckiser retained its #1 position with a 25.5% share of ad spends on television.

The top 10 advertisers contributed 72.7% of total TV ad spends.

Abbott Healthcare showed positive rank movement.

Two new entrants joined the top 10.

2025 (Jan–Mar)

Reckitt Benckiser continued to dominate with a 22.5% share.

The top 10 advertisers contributed 75.2% of TV ad spends.

Over 140 advertisers were active in this period.

Exclusive TV Advertisers in 2024

70 advertisers were exclusively active on television, highlighting continued value in niche visibility. Leading names included:

Axiom Ayurveda

Nutricia International

Ozone Pharmaceuticals

Encube Ethicals

Jay Bharat Spices

Herbalife Intl India

Empire Spices & Foods

USV

Emcure Pharmaceuticals

Preferred Channel Genres

General Entertainment Channels (GECs): Dominated with 51.9% share.

News: Secured the second spot with 16.2% share.

Sports, Movies, Infotainment followed.

This trend highlights how healthcare brands prefer mainstream entertainment to maximize visibility.

Preferred Time Bands for TV Advertising

Prime Time (6:00–10:59 pm): Captured 44.6% of ad volumes.

Afternoon (12:00–3:59 pm): 18.7%

Morning (9:00–11:59 am): 12.7%

Night (11:00 pm–5:59 am): 6.9%

Prime time remained the undisputed king for healthcare advertising.

Print Advertising Trends

Leading Advertisers

SBS Biotech retained its #1 spot in both 2023 (30.4% share) and 2025 (19.8% share for Jan–Mar).

New entrants in the top 10 list during 2024 included Ponds India, Zydus Lifesciences, and Himalaya Wellness Company.

Exclusive Print Advertisers in 2024

Over 320 advertisers were active exclusively in print, led by BC Hasaram & Sons, Ponds India, and Zydus Lifesciences.

Zone-Wise Print Ad Spend

North Zone: Dominated with 46.2% share.

West Zone: 27.5%

South & East Zones: Shared the remaining balance.

Ad Formats & Promotions

Color ads: 99.96% of all print ads.

Inside Pages: Most preferred at 48.7%, followed by back page (32.3%) and front page (18.7%).

Promotions: Sales promotions contributed 22.7% of spends, led by volume promotions (69.3%).

Radio Advertising Trends

2024

SBS Biotech led with a 27.2% share.

New entrants included Hamdard and MSD Pharmaceuticals.

2025 (Jan–Mar)

SBS Biotech strengthened its position with 47.8% share.

Top 10 advertisers captured 87.1% of radio spends.

Exclusive Radio Advertisers in 2024

Over 60 advertisers were exclusively active on radio, led by Ruchi Soya Industries, Vectura Fertin Pharma, and Morepen Laboratories.

Popular Radio Stations

Radio Mirchi was the top choice, followed by Big FM.

Zone-Wise Distribution

North Zone: 33.8%

West Zone: 33.5%

South & East Zones: Shared the rest.

Digital Advertising Trends

2024

Serum Institute of India rose to the #1 spot with 25.8% share, a remarkable leap from 11th place in 2023.

Reckitt Benckiser and GSK also improved their ranks.

Collectively, the top 10 advertisers accounted for 72.7% of digital spends.

2025 (Jan–Mar)

Bright Lifecare led with 15.7% share.

Top 10 advertisers contributed 52.5% of total digital spends.

Over 1,100 advertisers were active.

Exclusive Digital Advertisers in 2024

A whopping 1,360 advertisers were exclusive to digital. Top names included:

Axiom Ayurveda

Revive Essential Oils LLC

Supply Protein Supplements

Forever Nutrition

Kerala Ayurveda

Platforms and Formats

Facebook.com dominated with 46.4% share, followed by X.com (28.2%).

Display ads: 81.9% of volumes.

Video ads: 18.1% share.

Seasonal & Temporal Trends

Television: Peak advertising between March–July 2024.

Print: Highest activity during October–December 2024.

Radio: Strongest between April–August 2024.

Digital: Surged from June–December 2024.

Day-wise, television and digital campaigns were evenly spread across the week, while print peaked on weekends and radio on weekdays.

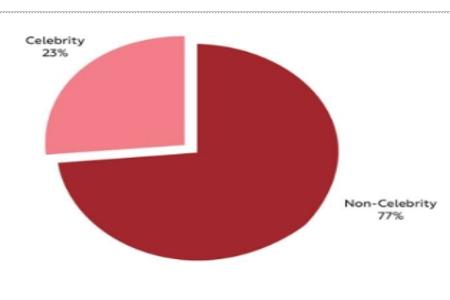

Celebrity Endorsements

Celebrity-backed campaigns accounted for 23% of total TV ad duration in the personal healthcare sector. Among them, Ajay Devgan emerged as the most visible celebrity in terms of ad duration.

Key Takeaways

Digital Dominance: With a 32% surge, digital is reshaping the healthcare advertising landscape.

Decline of Traditional Media: Television, print, and radio continue to lose advertiser count and ad spends.

Regional Strength: North India remains the strongest print advertising market, while TV thrives on GECs.

Exclusive Players: Hundreds of advertisers are still platform-exclusive, signaling that each medium holds unique relevance.

Celebrity Influence: Star power continues to be a significant driver for healthcare campaigns.

Conclusion

The personal healthcare sector is undergoing a major transformation. Digital advertising is not just an option but a necessity for brands looking to capture and engage audiences effectively. Traditional media, though still relevant, is gradually losing dominance.

For healthcare brands, the strategy ahead lies in integrated campaigns—balancing print and television for credibility while leveraging digital for scale, personalization, and measurable impact.

Partnering with an experienced agency like Excellent Publicity ensures that brands not only stay ahead of trends but also achieve maximum ROI on their advertising spends.

FAQs on Personal Healthcare Advertising

Digital platforms are the most effective, with ad spends increasing by 32% in 2024 compared to 2023. However, print still holds relevance due to credibility and regional reach.

Digital offers targeted reach, cost efficiency, real-time tracking, and measurable ROI, making it more attractive to advertisers.

Television: Reckitt Benckiser Print: SBS Biotech Radio: SBS Biotech Digital: Serum Institute of India (2024) and Bright Lifecare (2025)

The North Zone leads with 46.2% share, followed by the West Zone at 27.5%.

Celebrities endorse 23% of total TV ads in this sector, with Ajay Devgan being the most visible personality in 2024.

Prime time (6:00–10:59 pm) is the most preferred, accounting for nearly 45% of ad volumes.

By adopting a hybrid strategy—leveraging digital for targeted reach and performance, while using print/TV for credibility and mass awareness.