Table of Content

- 1. Executive Snapshot

- 2. About Excellent Publicity (Why This Report Exists)

- 3. Channel-by-Channel: What Changed & How to Respond

- 4. Regional Dominance Cheat Sheet

- 5. Creative & Placement Best Practices (By Medium)

- 6. 5 Media Mix Recipes (2025-Ready Starting Points)

- 7. Measurement & Ops: What to Track Weekly

- 8. Leadership Boards (At a Glance)

Executive Snapshot

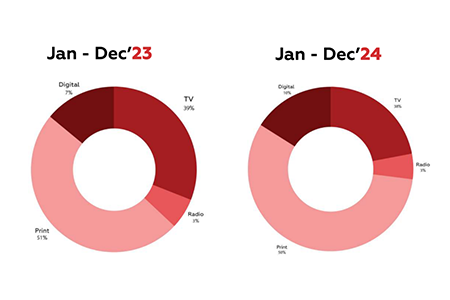

2024 was a recalibration year for personal care advertising in India. Budgets shifted out of Television and Print, while Digital and Radio captured fresh momentum, especially for ROI-focused and geo-targeted campaigns.

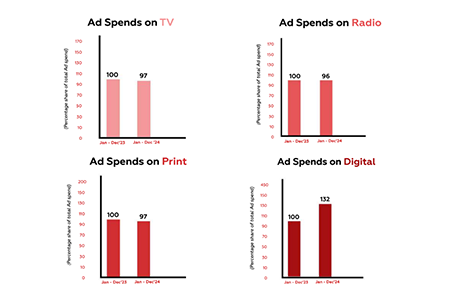

Spend shifts (Jan to Dec ’24 vs ’23):

- Television: 57%

- Print: 15%

- Radio: +22%

- Digital: +32%

Preferred medium: Print remained the most chosen vehicle by share (peaked at 69% in 2023; still led in 2024 despite a YoY decline).

Advertiser participation (’24 vs ’23):

- Digital: +42% (largest base of advertisers)

- Print: +4%

- Radio: –13%

- TV: –52%

Timing & seasonality:

- TV: Peaks Jan to Apr and Oct to Dec; Prime Time (18:00–22:59) carried 75.1% of ads; weekends strong.

- Print: Peaks Apr to Aug; Sundays dominate; front page (44.7%) and back page (33.8%) deliver premium visibility; 99.99% color ads.

- Radio: Peaks Apr to Dec; active across weekdays and Sundays; the West zone led with 51.2% of spending.

- Digital: Peaks Feb to Sep; ad volumes spread evenly across days; display (98.1%) dominated, video (1.9%) niche; Facebook (87.3%) and X (8.5%) led publishers.

This analysis turns the raw signals into action you can take into Q4 and 2025 planning—down to formats, dayparts, pages, regions, and measurement.

About Excellent Publicity (Why This Report Exists)

Headquartered in Ahmedabad, Gujarat, Excellent Publicity plans and executes 2,000+ campaigns annually across India and the MENA region, spanning media planning, digital & social, influencer, sports marketing, creative solutions, and corporate gifting. With 50K+ vendor tie-ups, 3K+ happy clients, and 13 years of category experience, this report distills learnings from real campaigns plus TAM Media Research inputs. (Disclaimer: We strive for accuracy but cannot guarantee absolute precision; feedback-driven updates are made within five working days.)

Channel-by-Channel: What Changed & How to Respond

1) Television: Smaller But Still Strategic

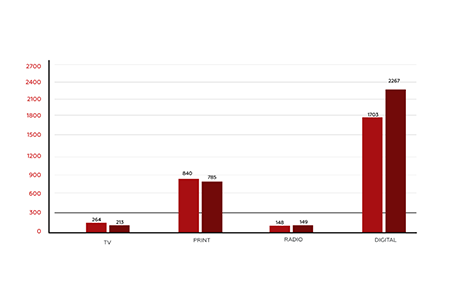

Spend: Down 57% YoY (’24 vs ’23); advertisers down 52% vs ’23.

Genre mix: News captured 81.2% of spending; GEC 15.9%; religious/movies minimal but useful regionally.

Time bands:

- Prime Time (18:00 to 22:59): 75.1%

- Afternoon (12:00 to 15:59): 7.2%

- Morning (09:00 to 11:59): 6.8%

- Early Morning (06:00 to 08:59): 6.2%

- Evening (16:00 to 17:59): 3.6%

- Night (23:00 to 05:59): 1.1%

Leaders:

- 2024: Barva Skin Therapie took #1 with 32.2% share (up from #5 in 2023). Med Manor Organics and SBS Biotech entered the Top 10.

- Q1 2025: Barva extended leadership to 66.1% share; only three advertisers were active on TV in Jan–Mar’25, and the Top 3, 100% of spending.

Exclusives (2024):

Nava Healthcare (#1), Noureea Healthcare, Hindustan Unilever, Shree Varma Bio Naturals, and Tanvi Herbal Clinic, brands that weren’t on TV in 2023 but advertised TV-only in 2024.

TV Playbook 2025

- If you’re on TV, be surgical. Prioritize Prime Time in News for credibility-led launches and GEC for family reach.

- Short, direct creatives: Problem–solution formats with visible pack, claim, dermatological/clinically proven proof, and a clear CTA.

- Pulse around high-attention windows: Budget for Jan to Apr (resolution/skin/hair resets) and Oct to Dec (gifting & wedding season).

2) Print: Still the Workhorse for Personal Care

Spend: 15% YoY (’24 vs ’23) but remained preferred by share.

Advertiser base: +4% vs ’23.

Color vs. B/W: 99.99% color (category norm).

Preferred positions: Front page (44.7%), back page (33.8%), and inside (21.1%).

Promotions: 24.2% of spending was tagged as sales promotions; add-on promotions dominated (89.0%), and discounts were 9.4%.

Seasonality: Peaks Apr to Aug; Sundays deliver maximum volume.

Zones: North (42.5%) led; West (25.3%) next.

Top publications: Dainik Jagran (North), Patrika (West), Ananda Bazar Patrika (East), Eenadu (South).

Leaders:

- 2024: Patanjali Ayurved #1 with 36.0% share; Gujarat Growmed Mkt (I) rose in rank. New Top-10 entrants at the #2, #5, #6, #7, #9 spots. Top 10 = ~89.5% of spend.

- Q1 2025: Patanjali retained #1 with 43.7%; Top 10, 95.8%; 35+ advertisers active.

Exclusives (2024):

Dr. ScDeb Homoeo Research Laboratory (#1), Jagravi Herbal Products, Dollar Company, Good Care Pharma, Uomo, Dr. Reddy’s Lab, Antex Pharma, K. P. Namboodiri, Krishna’s Herbal & Ayurveda, Atra Labs, and 70+ exclusive advertisers vs 2023.

Print Playbook 2025

- Anchor Sundays with front/back-page color; rotate Add-On (bundles/gifts) and Discount (limited periods).

- Regional dominance: Match North-heavy spends with Dainik Jagran; lean into Patrika/Eenadu/ABP where relevant.

- Track every ad: Edition-specific QR + UTM, vanity URLs, and unique offer codes to connect print exposure to store/commerce outcomes.

3) Radio: Momentum & Local Lift

Spend: +22% YoY (’24 vs ’23); advertiser count, 13% YoY (fewer but larger spenders).

Seasonality: Apr to Dec sustained peaks; active weekdays and Sundays.

Zones: West (51.2%) led; North (35.6%) followed.

Stations: Radio Mirchi #1; Big FM #2.

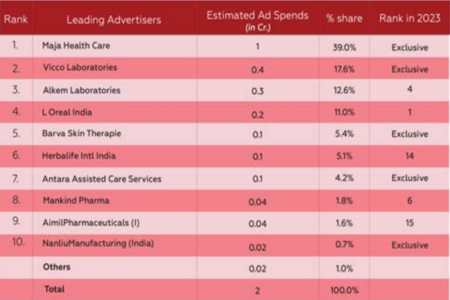

Leaders:

- 2024: Maja Health Care led with a 39% share; Alkem Laboratories rose. The top 10 accounted for 99% of radio spending; half of the top 10 were radio-exclusive.

- Q1 2025: Barva Skin Therapie dominated with 87%; only three advertisers were active; Top 3, 100%.

Exclusives (2024):

Maja Health Care (#1), Vicco Laboratories, Barva Skin Therapie, Antara Assisted Care Services, Nanliu Manufacturing (India), Koffeco, MDM Herbal Product, Bodytree Naturals, Honey Balm—9 exclusive radio advertisers (vs none in 2023).

Radio Playbook 2025

- Geo-first strategy: Cluster buys around top retail districts; RJ integrations Fri to Sun for weekend lift.

- Creative formula (20–25s): One problem–benefit, one offer (free sample/dermat trial/intro price), and one CTA (WhatsApp/store).

- Synchronize with print/digital during Apr to Dec to maximize festive and wedding-season momentum.

4) Digital: The Performance Engine

Spend: +32% YoY (’24 vs ’23); +42% advertisers YoY, largest active base.

Timing: Peaks Feb to Sep; even day-wise distribution.

Formats: Display 98.1%, Video 1.9%, heavy skew to commerce/retail/offer creatives.

Publishers: Facebook.com (87.3%); X.com (8.5%).

Leaders:

- 2024: Helios Lifestyle #1 with 11.9%; Happily Unmarried Marketing and Syscom Organic World rose; five new entrants in Top 10. Top 10, 67.2% of spend.

- Q1 2025: Lotus Herbals #1 with 11.4%; Top 10, 64.7%; 470+ advertisers active (note: this figure was listed under Radio in your draft; we interpret it as Digital activity count for Q1’25 given context).

Exclusives (2024):

Ayam Healthcare (#1), Revive Essential Oils LLC, MDC Pharmaceuticals, Hibiscus Monkey LLP, Heyman Lifestyle, Solistaa Pharmaceuticals, Ozone Pharmaceuticals, We Herbal, BTM Ventures, Dharishah Ayurveda, 590+ brands exclusive to digital vs 2023.

Digital Playbook 2025

- Meta-first (catalog/carousel/collection) with variant- and concern-based audience clusters (acne/anti-ageing/hairfall/brightening).

- Retail landing pages: <3s load, click-to-WhatsApp, trial/sample CTA, store locator, dermat endorsement above the fold.

- Lightweight video as amplifier around print/TV/radio bursts; keep 6 to 10s hooks with pack-in-hand demonstrations and proof badges.

Regional Dominance Cheat Sheet

Print:

- North (42.5%): Dainik Jagran

- West (25.3%): Patrika

- East: Ananda Bazar Patrika

- South: Eenadu

Radio:

- West (51.2%) led, then North (35.6%).

- Radio Mirchi > Big FM for Personal Care.

Why it matters: Personal care relies on trust and availability. Regional leaders carry outsized credibility; pairing them with retail-discovery tools (QR, WhatsApp, store locators) closes the loop.

Creative & Placement Best Practices (By Medium)

TV

- First 5 to 7 seconds: product-in-hand, claim, benefit payoff.

- Proof in frame: dermat-tested, % improvement, ingredient spotlight.

- Use News Prime for authority and GEC for family reach.

- Color always, front/back page for launches.

- Add-on promos (bundled freebies and minis) and discount math kept simple.

- QR + UTM per edition; store codes for attribution.

Radio

- One problem/benefit + one CTA.

- RJ live reads Friday to Sunday; mention store/WhatsApp clearly.

- Local language where possible.

Digital

- Display led (98%): carousels, collection pages, and offer variants.

- Video hooks: 6 to 10 seconds demos and testimonials.

- Automation: remarket page viewers and WhatsApp engagers within 24 to 48 hours.

5 Media Mix Recipes (2025-Ready Starting Points)

D2C Launch (National)

Digital 60 to 70%, Print 20 to 25%, TV 5 to 10%, Radio 5 to 10%

Focus: concern-led funnels, sampling, and creator whitelisting.

Retail Footfall Push (Metro)

Print 40 to 50% (front/back page weekends), Radio 15 to 20%, Digital 25 to 35%, TV 0–10%

Focus: store locators, RJ integrations, WhatsApp booking.

Dermat/Clinic Line Extension

Digital 55–65%, Print 20 to 25%, TV 10 to 15%, Radio 5 to 10%

Focus: proof-led creatives; News Prime cutdowns.

Wedding/Gifting Season (Oct to Dec)

Print 45 to 55%, Radio 15 to 20%, Digital 20 to 30%, TV 0 to 10%

Focus: bundles, add-ons, limited editions.

Q1 Skin/Hair Reset (Jan to Apr)

TV 10 to 20% (News Prime), Digital 45 to 55%, Print 20 to 30%, Radio 10 to 15%

Focus: resolution messaging, trials, dermatological endorsements.

Treat these as baselines. Reallocate 10 to 20% each month to proven winners (editions, stations, creatives, audiences).

Measurement & Ops: What to Track Weekly

- CPL / CAC by channel & creative; Lead. Trial. Purchase funnel.

- Edition/Station ROI via QR/UTM/vanity URLs and call tracking.

- First-response time: target <5 minutes (WhatsApp/call).

- Creative fatigue: rotate when CTR or store inquiries dip >15% vs 4 week average.

- Incrementality checks: hold-out markets or week-on/week-off rotations for Print/Radio.

Leadership Boards (At a Glance)

- TV 2024: Barva Skin Therapie #1 (32.2%); 2025 Q1: 66.1% share, Top 3. 100%.

- TV Exclusives 2024: Nava Healthcare (#1), Noureea Healthcare, HUL, Shree Varma Bio Naturals, and Tanvi Herbal Clinic.

- Print 2024: Patanjali Ayurved #1 (36.0%); 2025 Q1: 43.7%, Top 10 = 95.8%, 35+ active advertisers.

- Print Exclusives 2024: 70+ (e.g., Dr. ScDeb Homoeo Research Laboratory #1, K. P. Namboodiri, Dr. Reddy’s Lab, Krishna’s Herbal & Ayurveda, and Atra Labs).

- Radio 2024: Maja Health Care #1 (39%); 2025 Q1: Barva Skin Therapie 87%; Top 3. 100%.

- Radio Exclusives 2024: 9 (e.g., Maja Health Care, Vicco, Antara Assisted Care, Nanliu, Bodytree).

- Digital 2024: Helios Lifestyle #1 (11.9%); 2025 Q1: Lotus Herbals 11.4%; Top 10 ≈ 65–67%.

- Digital Exclusives 2024: 590+ (e.g., Ayam Healthcare #1, Revive Essential Oils LLC, Ozone Pharmaceuticals, Dharishah Ayurveda).

FAQs: Personal Care Advertising (2024 - 2025)

For retail-led brands: Print + Digital. Use front/back-page color on Sundays and always-on Meta with concern clusters. Layer Radio locally if you have store density.

Yes, selectively. Use News Prime for authority and GEC for family buys during Jan to Apr and Oct to Dec. Keep films short and proof-led.

The category leans toward Add-On Promotions (89%). Pair with simple discounts and trial bundles. Use QR/UTM to measure edition-level ROI.

Display-heavy (98%) with catalog/carousel, WhatsApp CTAs, remarketing within 24 to 48 hours, and lightweight video bumpers around offline bursts.

Anchor North with Dainik Jagran, West with Patrika, East with ABP, and South with Eenadu. On the radio, invest first in the West and North, starting with Radio Mirchi and then Big FM.

Add edition-specific QR/UTM to print, script a 20 to 25 second radio spot with one benefit and one CTA, and raise Meta retargeting caps Fri to Sun.