India’s Real Estate Advertising in 2024: A Cross‑Media Deep Dive (TV, Print, Radio, Digital)

Table of Content

- 1. TL;DR — What 2024 Taught Real Estate Marketers

- 2. Leaders by Channel (Exclusive Advertisers, 2024)

- 3. Where Ads Showed Up Most

- 4. Timing & Seasonality

- 5. Channel Share, 2022–2024

- 6. Media-Mix Recipes for 2025

- 7. Regional Nuances

- 8. Measurement: Watch These Weekly

- 9. Sample Weekly Flighting (Site-Visit Push)

- 10. Common Pitfalls

- 11. Planner & Templates

India’s Real Estate Advertising in 2024: A Cross-Media Deep Dive (TV, Print, Radio, Digital)

If you care about selling square feet, keeping your site visits buzzing, and nudging fence-sitters into booked units, 2024 offered a masterclass in Indian real estate advertising. This report distills what worked across TV, Print, Radio, and Digital, and turns it into practical media plans you can deploy in 2025.

TL;DR — What 2024 Taught Real Estate Marketers

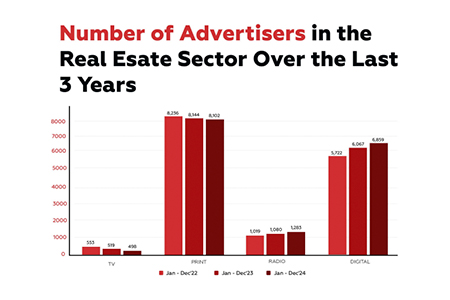

- Exclusive advertisers expanded across multiple channels: TV (300+), Print (4,200+), Radio (750+), and Digital (3,000+).

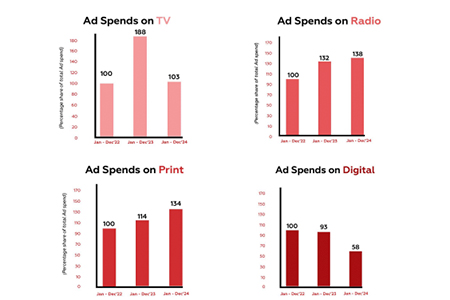

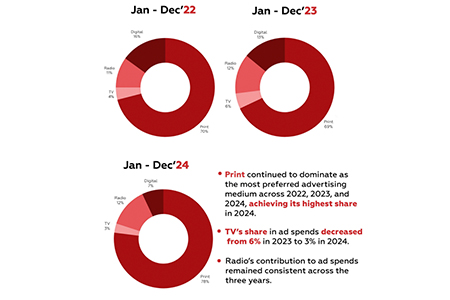

- Print dominated share of ad spends, growing to its highest level in 2024, while TV’s share fell from 6% to 3%.

- Weekends delivered the most volume for TV and Print; festive months (Aug–Nov) surged for Print and Radio.

- Digital stayed steady year-round—ideal for always-on discovery and retargeting.

Leaders by Channel (Exclusive Advertisers, 2024)

TV

Ananya Shelter (P) followed by VGN Projects Estates, Myron Homes, Azizi Developments, Getfarms, South India Shelters, DRA Homes, My Home Constructions, VGN Homes, Empire Housing & Property.

Why TV: trust-building and prestige, great for launches and top-of-funnel momentum.

Delhi Mall Complex; also Shaligram Developers (Bhopal), Raheja Universal, Bardiya Group, Delhi Commercial Shops, Signature Global Business Park, Group 108, Vision Developers (Jod), Terra Verde Builders & Developers, Raghav Realty.

Why Print: maps, renders, RERA numbers, and offers are easiest to digest here, still the champion of discovery.

Radio

Ruparel Realty; others include Shubham Group, Jain Constructions (Hyd), Vinayak Group, Galaxy Ventures, Smarthomes Infrastructure, Shubham Group (Jpr), Key Mansions, Karamchand Properties, Radhey Constructions India, Dharam Jewellers, World Gold Council India.

Why Radio: hyperlocal reach and cost-effective frequency for site-visit pushes.

Digital

Forum Riviera Constructions; others include Signature Global Business Park, Kleitos Ventures, Qiddiya Investment Company, ABC Infratech, Aspirar Villas, Takshashila Group, Gajra Home Builders, Aurum Analytica, Adhitrum Homes, Dharam Jewellers, World Gold Council India.

Why Digital: always-on demand gen, retargeting, and micro-market testing.

Where Ads Showed Up Most

- TV genres: Music, Sports, and Religious.

- Print publications: Times of India (South & West); Dainik Bhaskar (North & East; #2 in West).

- Radio stations: Radio Mirchi and Red FM.

Timing & Seasonality

Day-wise

Weekends (especially Saturday/Sunday) carried the highest ad volumes for TV and Print. Radio was more even with a Saturday uptick. Digital was steady across the week.

Monthly

Print and Radio peaked Aug to Nov (festive stretch). Digital was consistent. TV spikes are best aligned with high-attention events (sports/music/religious).

Channel Share, 2022–2024

Action Plans by Channel

Television

- Weekend bursts: concentrate GRPs Fri evening. Sun; add Sat morning blocks; use sports for launches and religious mornings for family decision-makers.

- Creative: location + price band + possession in the first 5–7 seconds; add a clear site-visit CTA.

- Inventory: lock TOI/DB in advance for Aug to Nov; use city supplements for micro-targeting.

- Creative: full-colour maps, renders, unit plans; include RERA and QR codes with edition-level UTMs.

Radio

- Flighting: stack GRPs in the fortnight before festival weekends; blend RJ endorsements with 10-sec bursts.

- Geo-targeting: focus pin-codes near sites; directional cues like “5 minutes from XYZ Metro”.

Digital

- Always-on + pulses: steady discovery/retargeting with micro-pulses around offline bursts.

- Landing page discipline: <3s load, price/location hero copy, instant forms, WhatsApp click-to-chat, maps, availability widgets.

Media-Mix Recipes for 2025

- Launch & Prestige (Tier-1): TV 35 to 45%, Print 25 to 35%, Digital 20 to 30%, Radio 5 to 10%.

- Mid-Market Launch (Tier-2/3): Print 35 to 45%, Radio 15 to 20%, Digital 30 to 40%, TV 5 to 10%.

- Always On Lead Gen: Digital 60 to 70%, Print 20 to 25%, Radio 10 to 15%.

- Festive Surge (Aug to Nov): Print 40 to 50%, Radio 15 to 20%, Digital 25 to 35%, TV 10 to 15%.

Regional Nuances

- South/West: lead with TOI; layer local-language dailies as needed.

- North/East: DB is essential; include Hindi belts in West for incremental reach.

- Radio: Mirchi & Red FM for scale; add strong local stations for niche dominance.

Measurement: Watch These Weekly

- Leads by channel and campaign; Lead. Visit and Visit. Booking rates.

- CQL (enforce budget band, locality, possession window).

- Time-to-first-response: under 5 minutes for WhatsApp/phone.

- Creative fatigue signals (4-week CTR baseline).

- Publisher mix outcomes (TOI vs DB by market).

Sample Weekly Flighting (Site-Visit Push)

- Mon to Thu: digital always-on; light radio (drive time); mid-week print teaser.

- Fri: raise digital bids; RJ mentions; TV music prime.

- Sat: print half-page/jacket; radio bursts; TV religious AM + sports/music PM; raise digital caps.

- Sun: print reinforcement; retargeting focus; light TV & radio.

- Mon: follow-ups with “Only X units left / Price protection till DD/MM”.

Common Pitfalls

- No QR/UTM discipline in print, fix with edition-level tags and unique landing pages.

- TV creative hiding price bands, show them upfront.

- Radio scripts overloaded with USPs, stick to one hero benefit + one CTA.

- Digital forms asking too much, use name + mobile + locality; qualify on WhatsApp fast.

Planner & Templates

Want an editable version of this playbook and a monthly planner? Plug your numbers into this structure and update benchmarks as new data lands.

FAQs (Fast Answers for Busy CMOs)

If you are in a metro with premium positioning, TV + TOI dual-strike is hard to beat. For Tier-2/3 value-driven launches, Print (DB) + Radio gives faster cost-per-lead wins. Always back with digital to harvest and nurture.

Yes, your report shows weekends as the hottest days for TV and Print, with Saturday particularly strong in Print and Radio. Align bursts to when families plan site visits.

No, but it’s the most efficient time for Print and Radio. That said, Digital should stay always-on and TV should be deployed around high-attention moments (sports/music/religious).

In real estate, mostly yes. Your data shows a vast majority of print ads were colour, and for good reason: better render visibility, higher noticeability, clearer maps, and stronger brand cues.

Add QR codes with UTM tags to all print executions, synchronize weekend TV + radio bursts, and raise digital retargeting caps Friday–Sunday. Watch site-visit numbers jump within a cycle.