Table of Content

Food Sector Advertising

Trends, Insights & Regional Dominance

(2023, 2024 & Jan–May 2025)

A Report & Analysis by Excellent Publicity

Offline | Digital | Sports | Gifting

The Food sector continues to transform as brands diversify media choices, respond to evolving consumption behavior, and adapt to the growing relevance of digital, sports, and regional advertising formats. This report outlines channel-wise performance, advertiser activity, regional trends, and evolving preferences that are shaping the food-category advertising ecosystem in India.

Insights presented here are derived from over 2,000 campaigns executed by Excellent Publicity and supported by data from TAM Media Research.

Disclaimer

The information presented is based on primary campaign execution and supporting media research. While efforts have been made to ensure accuracy, we cannot guarantee absolute precision. To suggest modifications, reach out to us; necessary changes will be implemented within five working days.

About Us

Headquartered in Ahmedabad, Gujarat, Excellent Publicity is a full-service agency helping businesses achieve their marketing goals through customized advertising solutions.

Our capabilities include:

- Media Planning & Buying

- Social Media Management

- Digital Marketing

- Influencer Marketing

- Sports Marketing

- Corporate Gifting

- Creative Services

We operate across Metro and Tier II cities in India and the MENA region and continue to expand our international presence.

Key scale indicators:

- 3,000+ Happy Clients

- 150+ Qualified Professionals

- 5 lakh+ Media Options

- 50,000+ Vendor Tie-ups

- 1.5 lakh+ Campaigns Executed

- 70,000+ Weekly Website Visits

- 13+ Years of Experience

- 7+ Offices across India & UAE

Learn more: https://excellentpublicity.com/

Summary of Key Takeaway

Television

- Parle Biscuits was the top advertiser in Jan–May 2025, contributing 33.7% of total TV ad spends.

- Sports dominated genre preference with 59.2% share; GEC followed with 22.9%.

- Prime Time delivered the highest ad volumes.

- Ranbir Kapoor was the most featured celebrity by TV ad duration.

- GCMMF became the leading print advertiser in Jan–May 2025, capturing 18.3% of total spend.

- The North Zone contributed the highest share at 46.4%.

- Times of India was the most preferred title across South & West; Dainik Bhaskar led in the North.

- Discount promos led print sales promotions at 35.2%.

Radio

- Mother Dairy Fruit & Veg rose to No. 1 in Jan–May 2025, with 8.7% share.

- Radio Mirchi was the most preferred station.

- West Zone led radio advertising at 43.8%.

Digital

- Cadbury India retained No. 1 in digital with a 16.2% share.

- Display formats dominated at 87% of volume.

- Facebook.com captured 81.6% of ad spends; YouTube followed at 11.8%.

Ad Spend Trend

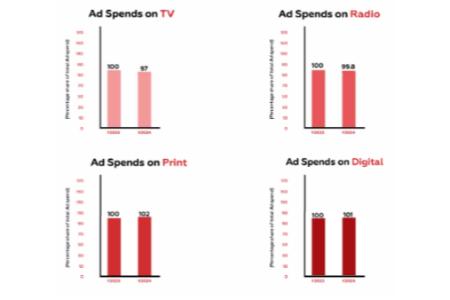

(2023 → 2024)

- Television: Down 3% in 2024 vs 2023

- Print: Up 2% in 2024

- Radio: Slight decline in 2024

- Digital: Up 1% in 2024

Digital and Print continued showing marginal upward growth as brand-building efforts broadened beyond television.

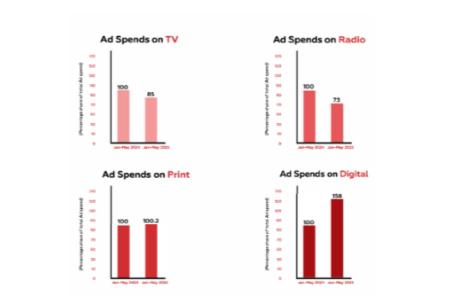

Quarterly Shift (Jan–May 2025 vs Jan–May 2024)

- Digital: Strongest rise in ad spending

- Television: Declined 15%

- Radio: Down 27%

Digital’s growth reflects increasing campaign measurability and audience segmentation.

Preferred Media Mix

| Year | TV | Digital | Radio | |

|---|---|---|---|---|

| 2023 | 78% | — | — | 2% |

| 2024 | 77% | +2% | +1% | 2% |

| 2025 | 80% | — | — | 1% |

Television continues to dominate (80% share in 2025). However, Digital and Print show consistent incremental gains.

Number of Advertisers (2023–2025)

Key observations:

- Digital has the highest number of advertisers, followed by Print.

- Radio declined 9% from 2022 to 2024.

- TV advertiser count fell 16% over the same period.

- Digital advertisers increased 24% in 2024 vs 2023.

The shift indicates stronger adoption of low-entry, high-scale channels.

Television Insights

Top Advertisers (Jan–May 2025)

- Parle Biscuits – 33.7%

- GCMMF – 11.0%

- Parle Products – 10.5%

- Cadbury India – 7.5%

- PepsiCo India – 3.8%

Other major advertisers included Britannia, ITC, Hatsun, Nestlé India, and HUL.

Top 10 contributed 81.8% of Food sector TV spending.

Exclusive TV advertisers

Key new category entrants included:

- VRB Consumer Products

- Dinshaws Dairy Foods

- Namaste India Foods

- Sneha Group

- (And several others)

Preferred Genres

- Sports – 59.2%

- GEC – 22.9%

- Movies, News, Music, Others – smaller shares

Sports emergence highlights the influence of live programming & high-impact inventory.

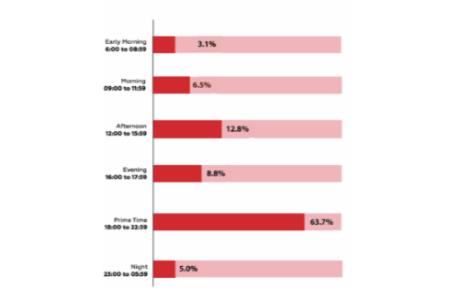

Time Bands

Highest activity occurred:

- Prime Time (18:00–22:59)

- Afternoon

- Evening

Monthly & Daywise Trends

- Feb–May saw the highest activity

- Weekends drove higher volumes

Celebrity Activity

Celebrity-endorsed ads represented 28.5% of category duration.

Ranbir Kapoor led, followed by Kajol, Ranveer Singh, Sara Ali Khan, and MS Dhoni.

Print Media Insights

Leading Advertisers (Jan–May 2025)

- GCMMF led at 18.3% share

- Shyam Oil Mill, ITC, Adani Wilmar rose in rank

- New entrants: Mother Dairy, Pravin Masalewale, Agrawal Papad

Top-10 accounted for ~50% of category print spending.

Exclusivity

470 advertisers were active only on Print.

Regional Mix

- North – 46.4%

- West – 23.6%

- South & East – remaining share

Preferred Publications

- West & South – Times of India

- North – Dainik Bhaskar

- East – Anandabazar Patrika

Ad Format & Placement

- 99.7% colour ads

- Placement split:

- Inside Pages: 51.8%

- Front Page: 32.0%

- Back Page: 15.2%

Promotions

19.9% of print spends supported sales promotions:

- Discount Promotion – 35.2%

- Add-On Promotion – 23.8%

Timing

Peak activity: February–April

Higher frequency on weekends.

Radio Insights

Top Advertisers (Jan–May 2025)

- Mother Dairy Fruit & Veg – No. 1 (8.7%)

- Positive movement: Patanjali, Gemini Edibles, Adani Wilmar

- New entrants: Vikram Roller Flour Mills, Vimal Agro

Top-10 accounted for 44.7% of category radio spending.

Exclusive Radio Advertisers

~90 brands were exclusive to Radio during Jan–May 2025.

Preferred Stations

- Radio Mirchi

- My FM

Regional Split

- West: 43.8%

- North: 34.4%

Radio activity peaked Feb–May, largely driven by weekday scheduling.

Digital Insights

Leading Advertisers (Jan–May 2025)

- Cadbury India – 16.2%

- Seven new entrants in Top-10 vs 2024

Top-10 contributed 56.6% of category digital spend.

Exclusive Digital Advertisers

1,080 advertisers were active only on digital platforms.

Platform Preference

- Facebook.com – 81.6%

- YouTube.com – 11.8%

Ad Formats

- Display – 87%

- Video – 13%

Peak season: February–April

Activity was distributed evenly across all days.

Strategic Implications

TV remains dominant, but brands must optimize for sports, GEC, and prime-time inventory.

Digital is rapidly expanding, especially through display and social platforms; high-reach brands must invest in multi-format content.

Print offers deep regional targeting, particularly in North & West through tiered publication strategies.

Radio is strong where proximity matters, allowing efficient regional coverage.

Celebrity involvement is meaningful, but non-celebrity content still forms the majority share.

How Excellent Publicity Can Support You

With over 50,000 vendor tie-ups and campaigns across every major category, we help Food & FMCG brands build targeted, full-funnel campaigns across India and MENA.

Our strengths:

- National & Regional Media Strategy

- Print, TV, Radio & Digital Buying

- Retail & Rural Activation Programs

- Influencer & Social Campaigns

- Creative & Production Support

Whether your brand needs hyperlocal expansion or mass-reach planning, we tailor solutions to your goals.

Explore: https://excellentpublicity.com/