Table of Content

- 1. About Excellent Publicity

- 2. Ad Spend Trend (Jan–Dec 2023 vs Jan–Dec 2024)

- 3. Quarterly Shift (Jan–May 2025 vs Jan–May 2024)

- 4. Preferred Media Mix

- 5. Number of Advertisers (last three years)

- 6. Television Deep Dive

- 7. Print Deep Dive

- 8. Radio Deep Dive

- 9. Digital Deep Dive

- 10. Category Playbook: What Wins in 2025

- 11. How Excellent Publicity Can Help

Trends, Insights, and Regional Dominance

A Report & Analysis by Excellent Publicity

The beverage market—spanning dairy, packaged drinks, tea and coffee, juices, energy drinks, and aerated beverages—moved through a volatile but ultimately proactive year. Budgets rotated sharply between channels in 2024, then pivoted again in early 2025 as brands chased attention around live sports, festive windows, and seasonal heat spikes. Below is a practical synthesis of where money moved, which formats performed, and how advertisers can plan smarter for the next flight.

These insights are grounded in more than 2,000 campaigns executed by Excellent Publicity, with supplementary inputs from TAM Media Research.

About Excellent Publicity

Excellent Publicity is a full-service advertising partner headquartered in Ahmedabad, Gujarat. We help brands achieve measurable growth through media planning and buying, digital marketing, social and influencer programs, sports marketing, corporate gifting, and end-to-end creative solutions.

- 3,000+ happy clients

- 150+ specialists

- 5 lakh+ media options

- 50,000+ vendor tie-ups

- 1.5 lakh+ campaigns executed

- 70,000+ weekly website visits

- 13+ years of serving clients

- 7 offices across India & UAE

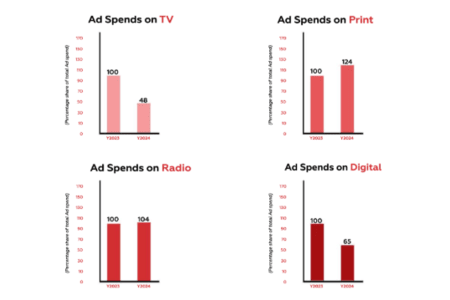

1) Ad Spend Trend (Jan–Dec 2023 vs Jan–Dec 2024)

- Television: Down 52% in 2024 vs 2023.

- Print: Up 24% year-on-year.

- Radio: Up 4% year-on-year.

- Digital: Down 35% year-on-year.

Takeaway: 2024 was a classic rebalancing year. Brands paired TV and Digital at scale while leaning into Print (trust plus regional depth) and keeping Radio steady for frequency in key city clusters.

2) Quarterly Shift (Jan–May 2025 vs Jan–May 2024)

- Digital: Surged (index ~133) – the biggest mover.

- TV: Up ~16% vs the same period last year.

- Print: Up ~10% vs the same period last year.

- Radio: Down ~12% vs the same period last year.

Takeaway: Early 2025 shows a return to high-impact media—live sports on TV and strong social/video on digital—while Radio softened after an active 2024.

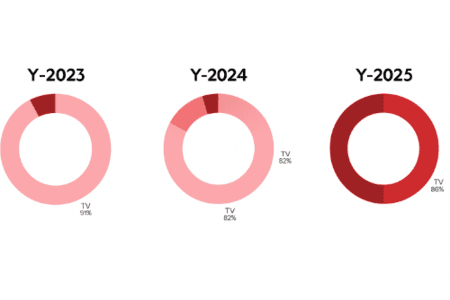

3) Preferred Media Mix

2023: Television dominated with a massive 91% of ad spend.

2024: Share began to diversify; Print doubled, Radio +67%, Digital +83% (vs prior reference).

Jan–May 2025: TV’s share rebounded strongly (up ~69% vs 2024), as brands rode marquee sports and tent-pole events.

Implication: Beverage is highly event-sensitive. Television regains leadership when supply of premium live content spikes; Digital follows with performance and video bursts; Print retains credibility for brand and trade narratives.

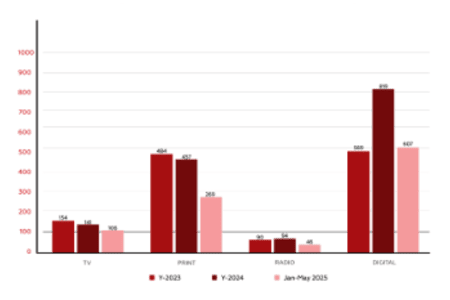

4) Number of Advertisers (last three years)

Digital had the highest advertiser count, followed by Print.

2024 → Jan–May 2025: Radio advertisers fell 51%; TV advertisers fell 25%; Digital advertisers fell 26% (2024 vs Jan–May 2025 snapshot).

Implication: Even with TV and Digital spend rebounding in 2025, the breadth of participating brands tightened—indicative of concentrated spending by larger players and cautious testing by mid-sized advertisers.

5) Television Deep Dive

5.1 Top Advertisers (Jan–May 2025)

Reliance Consumer Products jumped to No. 1 with 25.8% share (up from 6th in Jan–May 2024).

Parle Agro and Nestlé India moved up.

Hell Energy entered the Top 10.

Top 10 together delivered 92.1% of category TV spend.

5.2 Genres and Time Bands

Sports led with 58.6% share; GEC followed at 23.3%.

Prime Time (18:00–22:59) carried the highest delivery, with Afternoon and Evening next.

5.3 Monthly and Day-wise Patterns

Peak activity February to May across both observed periods.

Weekends saw the heaviest volumes, consistent with high-reach sports and family co-viewing.

5.4 Celebrity Impact

35.7% of TV ad duration used celebrities.

Shah Rukh Khan led by screen time among ambassadors.

Planning note: Use TV for marquee bursts—sports, finals, and festival runs—with heavy rotation in Prime Time and tactical daypart pulses around match schedules.

6) Print Deep Dive

6.1 Top Advertisers (Jan–May 2025)

GCMMF retained No. 1 with 24.0% share.

Hamdard and Shree Guruji Products climbed.

New Top-10 entries: Ghanshyamdas & Co., Reliance Consumer Products, PepsiCo.

Top 10 delivered ~67.6% of print spend.

6.2 Exclusivity and Regional Mix

125 advertisers were exclusive to print in Jan–May 2025.

North Zone led with 48.9% share; West followed at 22.2%.

6.3 Preferred Publications

Dainik Bhaskar led in North & East.

The Times of India led in the West.

Eenadu led in the South.

6.4 Formats, Placement, and Promotions

99.9% of ads were in colour.

Placements: Inside pages 49%, Front page 33.5%, Back page 17.4%.

11% of spend went to promotions: Discount Promotion 62.7%, Add-On Promotion 28.2%.

6.5 Timing

Print peaked February–April; heavier weekend presence.

Planning note: For brand education, launches with regional tailwinds, and trade signaling, combine front-page pulses with inside-page continuity across key zonal publications.

7) Radio Deep Dive

7.1 Top Advertisers (Jan–May 2025)

Mother Dairy Fruit & Veg climbed to No. 1 with 48.5% share (up from No. 2).

Coca-Cola India and Pawanshree Food International improved ranks.

Top 10 together delivered 91.7% of category spend.

7.2 Exclusivity, Stations, and Regions

~20 brands appeared as exclusive radio advertisers during Jan–May 2025.

Radio Mirchi was the most used station; Red FM close behind.

North Zone 48.6%, West 28.4% of radio spend.

7.3 Timing

Peaks February–May; activity skewed to weekdays, aligning with commute and at-work listening.

Planning note: Use radio for regional frequency and tactical price/offers near modern trade clusters; amplify during heat waves and weekend retail pushes.

8) Digital Deep Dive

8.1 Top Advertisers (Jan–May 2025)

Coca-Cola India rose to No. 1 with 54.0% share (from No. 2).

Seven of the Top-10 were new entrants vs 2024.

The top 10 delivered 80.6% of digital spend.

8.2 Platforms and Formats

YouTube led with 63.0% share; Facebook at 29.8%.

Video dominated at 64.1% of digital ad volumes; Display at 35.9%.

8.3 Seasonality and Cadence

Digital surged February–April; delivery was evenly spread across all days.

Planning note: Pair high-impact video (YouTube mastheads, sports and music affinity) with performance display and retargeting. Build creative systems for quick edit swaps around weather, offers, and flavours.

9) Category Playbook: What Wins in 2025

Anchor to Sports and Heat Maps

Beverage demand spikes with temperature and live events. Use TV Sports for reach, YouTube for video depth, and social for moment marketing.

Zonal Precision in Print

North and West carry outsized weight. Build city-level plans around Dainik Bhaskar, TOI, and leading language dailies; pulse front pages during launches and long weekends.

Radio for Proximity and Price

Leverage Radio Mirchi/Red FM for week-day frequency and RJ integrations. Tie creative to local retail availability and MRP packs.

Video-First Digital, Performance-Always

Maintain always-on performance, but prioritize video for flavour launches and seasonal bursts. Retarget viewers to commerce or store-locator journeys.

Celebrity Equity, Managed Smartly

With SRK leading TV visibility and multiple celebrity touchpoints across brands, ensure copy–persona fit and distinctive brand assets to avoid creative clutter.

Test-and-Scale

The advertiser base narrowed in 2025 while spending concentrated among leaders. Smaller brands should pilot, learn, and scale—not spray and pray.

10) How Excellent Publicity Can Help

We combine buying scale with category depth to design high-impact beverage campaigns across India and MENA.

What we do

- TV, Print, Radio, Digital planning and buying

- Sports integrations and event-led bursts

- Creator & influencer programs

- Creative production and versioning at speed

- Measurement: MMM guidance, geo-tests, incrementality, brand lift

Where to start

- Seasonal calendar and heat map

- City and zone priorities

- Budget split across TV Sports, YouTube video, Print pulses, Radio frequency, and always-on performance

Planning a beverage launch or seasonal boost?

Excellent Publicity will build a zonal, event-led media plan that blends TV Sports reach, video-first digital, regional print credibility, and radio frequency—optimized for outcomes.